6 Easy Facts About Outsourced Cfo Services Explained

Table of ContentsA Biased View of Vancouver Tax Accounting CompanyThe Single Strategy To Use For Vancouver Accounting FirmThe smart Trick of Vancouver Accounting Firm That Nobody is DiscussingIndicators on Vancouver Tax Accounting Company You Need To Know

That happens for every solitary transaction you make throughout a provided accounting duration. Working with an accounting professional can help you hash out those details to make the bookkeeping process work for you.

What do you perform with those numbers? You make modifications to the journal access to ensure all the numbers accumulate. That may include making modifications to numbers or dealing with built up things, which are expenses or earnings that you incur but don't yet pay for. That obtains you to the changed test balance where all the numbers include up.

For aspiring financing experts, the inquiry of bookkeeper vs. accounting professional prevails. At first, bookkeepers as well as accounting professionals take the same fundamental audit programs. Nonetheless, accounting professionals go on for additional training and education, which results in distinctions in their functions, incomes expectations and occupation development. This overview will supply a thorough failure of what separates accountants from accounting professionals, so you can understand which accountancy function is the most effective suitable for your career desires currently as well as in the future.

The Greatest Guide To Cfo Company Vancouver

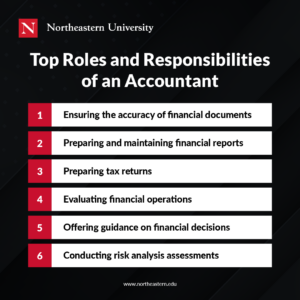

An accounting professional develops on the info offered to them by the bookkeeper. Usually, they'll: Review economic declarations prepared by a bookkeeper. Assess, analyze or vouch for this info. Transform the info (or records) right into a report. Share recommendations and make referrals based upon what they've reported. The documents reported by the accountant will figure out the accountant's recommendations to leadership, and also inevitably, the health and wellness of business overall.

e., government agencies, universities, healthcare facilities, etc). An experienced as well as proficient accountant with years of experience as well as first-hand expertise of accounting applications ismost likelymore certified to run the books for your organization than a recent bookkeeping significant graduate. Keep this in mind when filtering system applications; attempt not to evaluate candidates based upon their education and learning alone.

Organization estimates as well as trends are based on your historic economic information. The monetary data is most dependable and accurate when provided with a durable and also organized audit procedure.

The 4-Minute Rule for Tax Consultant Vancouver

Accounting, in the conventional sense, has actually been about as long as there has actually been commerce given that around 2600 B.C. A bookkeeper's task is to maintain full documents of all cash that has entered into as well as headed out of business - small business accountant Vancouver. Bookkeepers document everyday transactions in a regular, easy-to-read method. Their documents enable accountants to do their jobs.

Normally, an accountant or owner looks after a bookkeeper's job. An accountant is not an accountant, nor should they be taken into consideration an accounting professional.

Three primary factors impact your expenses: the solutions you want, the experience you need and your regional market. The bookkeeping solutions your business demands as well as the amount of time it takes regular or monthly to finish them impact just how much it sets you back to hire an accountant. If you need somebody ahead to the workplace when a month to fix up the publications, it will cost much less than if you need to hire somebody permanent to handle your daily operations.

Based upon that calculation, determine if you need to hire someone full time, part-time or on a job basis. If you have intricate books or are bringing in a whole lot of sales, employ a licensed or certified accountant. A seasoned accountant can give you comfort and also self-confidence that your financial resources are in great hands yet they will also cost you extra.

Everything about Tax Consultant Vancouver

If you live in a high-wage state like New York, you'll pay even more for a bookkeeper than you would certainly in South Dakota. There are numerous benefits to working with an accountant to submit as well as document your service's financial records.

They might go after additional qualifications, such as the CPA. Accounting professionals may also hold the position of accountant. If your accounting professional does your accounting, you might be paying more than you must for this service as you would generally pay even more per hr for an accounting professional than an accountant.

To finish the program, accounting professionals need to have 4 years of appropriate job experience. The point right here is that employing a CFA indicates bringing highly sophisticated accountancy knowledge to your business.

To obtain this accreditation, an accountant should pass the needed examinations and also have two years of specialist experience. CPAs can do a few of the same services as CIAs. You could work with a CIA if you want a more specific emphasis on monetary risk assessment as well as security tracking processes. According to the BLS, virtual CFO in Vancouver the typical salary for an accounting professional in 2021 was $77,250 per year or $37.