Explore the Scope of Works Offered by Mission Tax & Business Advisory to Boost Your Business

Mission Tax & Business Advisory offers a substantial variety of solutions designed to boost Business efficiency. Their knowledge covers Tax preparation, conformity, and strategic consulting, guaranteeing businesses can navigate monetary intricacies successfully. Mission Tax & Business Advisory. They also concentrate on financial declaration preparation, payroll administration, and worker benefits. Each service intends to promote and simplify operations development. As services deal with evolving challenges, understanding the full range of these offerings could be essential for continual success. What can these services really attain for your company?

Comprehensive Tax Preparation and Compliance

Compliance, on the various other hand, assures that all Tax obligations are satisfied properly and prompt, preventing prospective fines and interest. By employing an organized approach, Tax specialists can determine possibilities for Tax cost savings, assisting customers navigate intricate Tax situations.

Routine reviews of financial techniques and Tax placements are crucial, as changing circumstances can influence Tax responsibilities. Ultimately, considerable Tax planning and conformity not only guard versus legal effects however also supply a solid structure for economic stability and growth, making it possible for clients to concentrate on their core goals without tax-related distractions.

Strategic Business Consulting Services

While businesses frequently concentrate on prompt operational difficulties, tactical consulting services play a vital role in long-term growth and sustainability. Mission Tax & Business Advisory provides tailored options that help companies identify and take advantage of their special staminas - Mission Tax & Business Advisory. By assessing market problems and competitive landscapes, these getting in touch with solutions guide businesses in creating strategies that straighten with their objectives

The company stresses the significance of creating a clear vision and actionable strategies, enabling clients to navigate intricacies successfully. With comprehensive evaluations, Mission Tax & Business Advisory helps in pinpointing areas for renovation and technology. This proactive method not just alleviates dangers yet also improves functional performances.

Their strategic consulting promotes a culture of notified decision-making, equipping leaders to make options that drive efficiency. Ultimately, these services equip organizations with the tools needed to prosper and adjust in an ever-evolving industry, ensuring they continue to be competitive and resilient despite obstacles.

Financial Declaration Preparation and Analysis

Exact economic declaration preparation and evaluation are vital elements for services seeking to assess their economic health and make informed choices. Mission Tax & Business Advisory focuses on supplying comprehensive financial statement solutions that consist of the prep work of balance sheets, revenue declarations, and money circulation statements. By ensuring these papers are thoroughly prepared, organizations can get a clearer understanding of their monetary position and functional efficiency.

Along with preparation, Mission Tax & Business Advisory emphasizes the value of monetary evaluation. This entails examining vital metrics and trends to identify locations of stamina and chances for renovation. By translating economic data properly, organizations can make tactical choices that drive growth and boost success. The insights gotten via rigorous monetary declaration evaluation empower business proprietors to capitalize and navigate challenges on market possibilities, ultimately sustaining the long-term success of their ventures.

Entity Framework and Business Formation Guidance

Selecting the right entity framework is vital for organizations as it can considerably impact taxation, obligation, and functional versatility. Mission Tax & Business Advisory gives expert advice in traversing the complexities of Business development. They assist clients in choosing the most ideal entity kind-- whether a sole proprietorship, collaboration, LLC, or corporation-- customizing suggestions to specific Business needs and goals.

The consultatory team reviews numerous aspects, such as the nature of business, potential threats, and lasting objectives. This detailed evaluation aids clients recognize the implications of each structure, consisting of Tax obligations and individual responsibility defense. In Addition, Mission Tax & Business Advisory aids in the formation process, guaranteeing compliance with legal demands and smooth registration with governmental authorities. By leveraging their competence, companies can establish a strong foundation that supports growth while decreasing possible difficulties connected with inappropriate entity choice.

Payroll Services and Staff Member Benefit Solutions

Effective pay-roll services and comprehensive fringe benefit services are vital parts for companies intending to preserve and attract talent. Mission Tax & Business Advisory offers extensive payroll administration that guarantees precision and conformity with Tax regulations, lowering administrative problems on employers. This service consists of timely handling of payroll, administration of reductions, and generation of essential records.

On top of that, Mission Tax offers customized fringe benefit remedies, which include health and wellness insurance policy, retirement, and other rewards. These offerings enable companies to develop competitive payment bundles that satisfy the diverse needs of their workforce. By leveraging these services, business can enhance staff member contentment and interaction, inevitably cultivating a productive workplace culture.

With a focus on both payroll efficiency and staff member well-being, Mission Tax & Business Advisory helps organizations simplify procedures and boost their general appeal to possible and existing employees, positioning them for long-term success in their corresponding sectors.

Danger Monitoring and Financial Advisory Providers

Danger management and economic advising services play an essential duty in assisting companies navigate uncertainties. By applying effective danger assessment strategies, companies can recognize possible threats and establish proactive steps. Furthermore, tailored financial preparation services are important for straightening Business objectives with danger tolerance, inevitably cultivating lasting development.

Risk Evaluation Strategies

Businesses face an array of unpredictabilities, implementing durable risk evaluation approaches is crucial for maneuvering potential difficulties. Mission Tax & Business Advisory stresses the importance of identifying, examining, and focusing on threats to guard Business properties and assure functional continuity. By employing an organized method, companies can evaluate potential hazards, consisting of financial, functional, and compliance-related risks. Making use of qualitative and measurable techniques, services can redirected here get insights right into their danger direct exposure, facilitating educated decision-making. Continuous surveillance and revisiting danger evaluations make it possible for adaptability in a vibrant market atmosphere. With specialist assistance, business can create tailored methods that not only minimize risks yet also boost total strength. Effective risk management ultimately fosters a safe foundation for lasting growth and success.

Financial Preparation Solutions

Frequently Asked Concerns

What Industries Does Mission Tax & Business Advisory Serve?

Mission Tax & Business Advisory offers a varied range of markets, consisting of health care, building and construction, technology, production, and retail - Mission Tax & Business Advisory. Their proficiency permits services in these markets to browse intricate Tax and advisory obstacles efficiently

How Can I Arrange an Appointment With Mission Tax & Business Advisory?

To schedule an appointment with Mission Tax & Business Advisory, individuals can see their official internet site, complete the call type, or call their workplace straight to talk about offered visit choices and services.

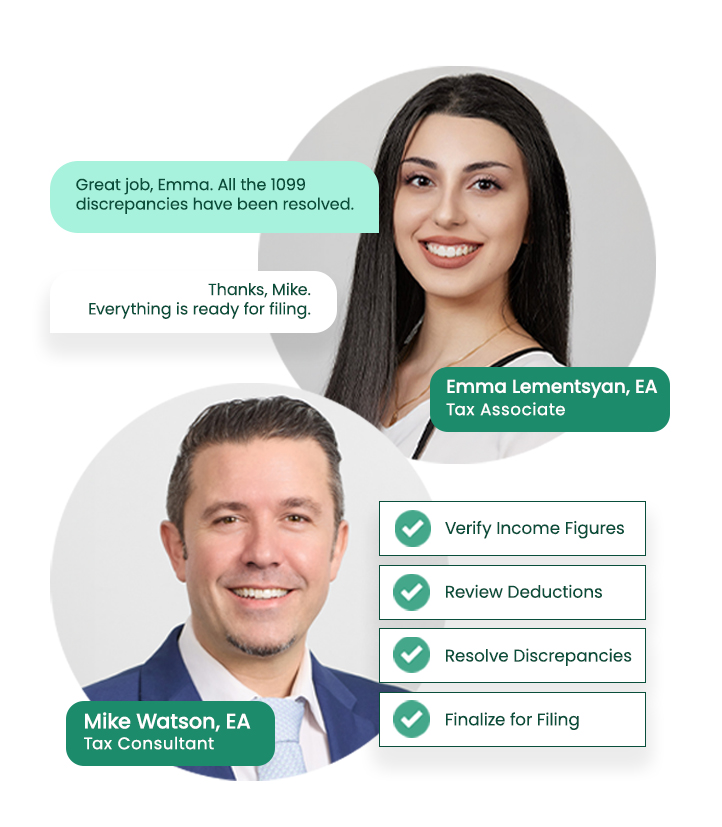

What Are the Qualifications of Your Advisors?

The consultants have substantial certifications, including these details postgraduate degrees in bookkeeping and financing, expert certifications like certified public accountant or CMA, and years of sector experience, guaranteeing they offer professional support customized to customers' unique Business requirements.

Do You Deal Services for Startups and Local Business?

Yes, Mission Tax & Business Advisory offers customized solutions specifically created for startups and little companies, focusing on Tax preparation, conformity, and calculated suggestions to cultivate development and assurance monetary stability in an open market.

What Is the Regular Timeline for Completing Income Tax Return?

The common timeline for completing tax returns generally varies from 2 to six weeks, depending on the complexity of the financial scenario and the responsiveness of the customer in supplying required documentation and details.

Mission Tax & Business Advisory uses a comprehensive selection of services developed to boost Business efficiency. Their know-how extends Tax preparation, compliance, and strategic consulting, making certain businesses can navigate financial intricacies efficiently. Extensive Tax planning and pop over to this web-site conformity is essential for individuals and companies aiming to enhance their monetary results while adhering to Tax guidelines. Mission Tax & Business Advisory gives skilled guidance in traversing the complexities of Business development. Mission Tax & Business Advisory highlights the importance of identifying, analyzing, and focusing on threats to safeguard Business assets and assure functional continuity.